On January 25, The Group hosted its Annual Real Estate Forecast, back in person for the first time since the start of the pandemic. Group President and CEO Brandon Wells recapped some of the overarching themes we saw in 2022 and pointed to various trends that will shape the housing market in the coming year. Most notably, he discussed the probability that home prices in Northern Colorado will stabilize in 2023 after years of historically high housing prices coupled with historically low interest rates.

During the forecast, we also heard from Jason Peifer of Group Mortgage, who discussed mortgage interest rates, and a panel composed of representatives from three Northern Colorado communities, discussing key planning and development objectives for the year ahead.

Let’s take a closer look at some of the prominent trends that emerged and shaped the real estate market in Northern Colorado over the past calendar year, and how they will in turn shape the months ahead.

Predictions vs. Reality

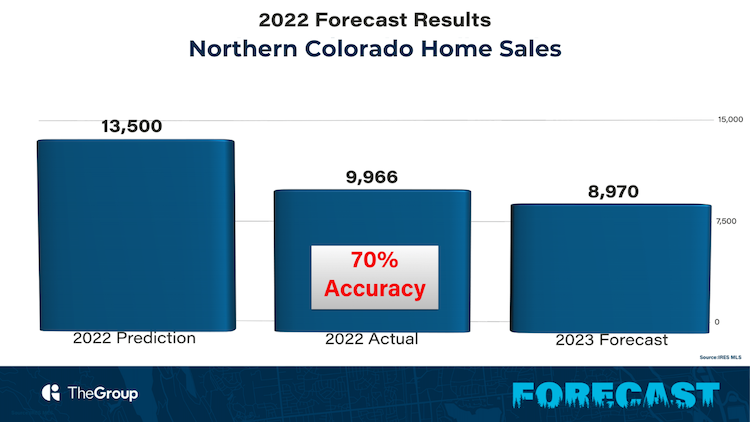

Over the years, our forecasts for home sales and average sales price have been between 95 and 99 percent accurate. This year, we were slightly less accurate with our prediction for the number of homes sales, as we were shocked by how quickly the fight against inflation impacted the marketplace across the country. During last year’s forecast, we predicted there would be 13,500 home sales in Northern Colorado in 2022. But in reality, there were only 9,966 home sales, which meant our prediction was only 70% accurate.

Similarly, there was a decrease in annual closed sales across the board. From 2021 to 2022, Windsor/Severance decreased 42%, Loveland decreased 28%, and Fort Collins decreased 27%, and the majority of the region followed this downward trend, as all of Northern Colorado (excluding Longmont, Boulder and Estes Park) went from 13,148 to 9,966, which was a decrease of 24%.

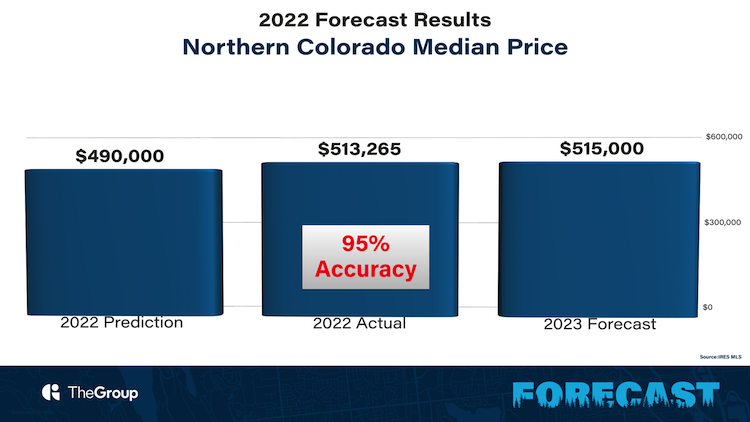

Unlike our prediction for home sales, our forecast for median price was much more accurate. We predicted a median price of $490,000 throughout Northern Colorado in 2022. The actual median price was $513,265, an appreciation that was higher than expected, but means our prediction was 95% accurate.

Our Predictions for 2023

For 2023, our prediction for 2023 is 8,970 home sales, which represents a 10% decrease year over year and a median price of $515,000, which is slightly higher than what we saw in 2022 — $513,265. Overall, we’re anticipating a relatively flat market, which is something we haven’t been accustomed to in recent years, as we’ve seen 124 straight months of increasing home prices. 2023 is expected to be an inverse of 2022, which had a strong start and a slower finish. Housing activity in the first and second quarters of 2023 will be slower, but as consumer confidence strengthens around housing, the third and fourth quarters should witness improved conditions.

Over the last few years, we’ve seen pretty consistent themes in real estate across the country: super high demand, limited supply, escalating prices, multiple offers, etc. Now, we’re expecting to see more varied stories within each individual market, as real estate becomes more hyperlocal once again — creating microclimates within the larger ecosystem. And here in Northern Colorado, we’ll see variation between our different communities, instead of sweeping generalizations that apply to the whole region.

Inflation Trends

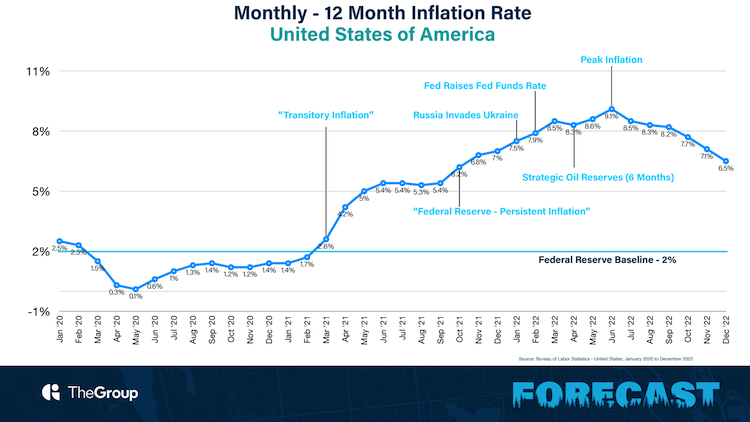

Inflation is at the heart of what has happened over the last year and what will happen in the year ahead. This graphic helps illustrate the steady rise and fall in inflation rates. It highlights some of the major events that took place between January 2020 and December 2022, from the Russian invasion of Ukraine to tapping into our strategic oil reserves, both of which greatly impacted the trajectory of inflation.

The good news is: although we are still well above the Federal Reserve’s baseline of 2%, inflation is lowering. And mortgage markets have reacted favorably to that.

More Interest in Rates

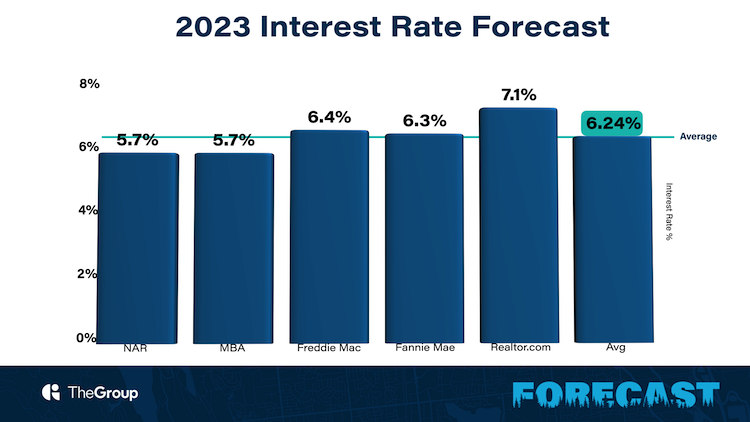

To talk about interest rates, we welcomed Jason Peifer, president of Group Mortgage, to the stage. He shared the interest rate forecast from several entities, including the National Association of REALTORS, Freddie Mac, Fannie Mae, and more, which averaged 6.24%. Peifer warned we should take this prediction with a grain of salt, as so many factors affect interest rates, from the volume of treasuries and bonds competing for funds to shelter costs stabilizing.

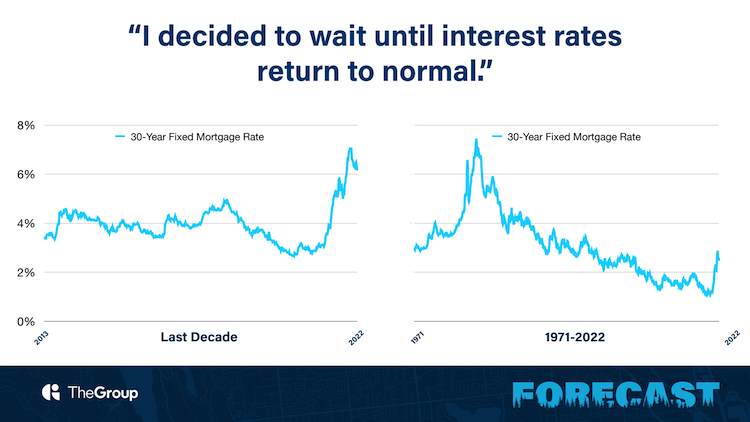

For those saying, “I’m going to wait until interest rates return to normal,” Peifer reminds us that rates are returning to normal. When compared to interest rates over the last decade, 7% feels high, but when compared to rates going back to 1971, 3% isn’t necessarily normal.

More than interest rates, the real challenge is affordability, a story that we’ve seen in headlines time and time again. But overall, income has also increased alongside rising prices, which can often make up for those additional costs — sometimes with some change left over.

Millennial Support

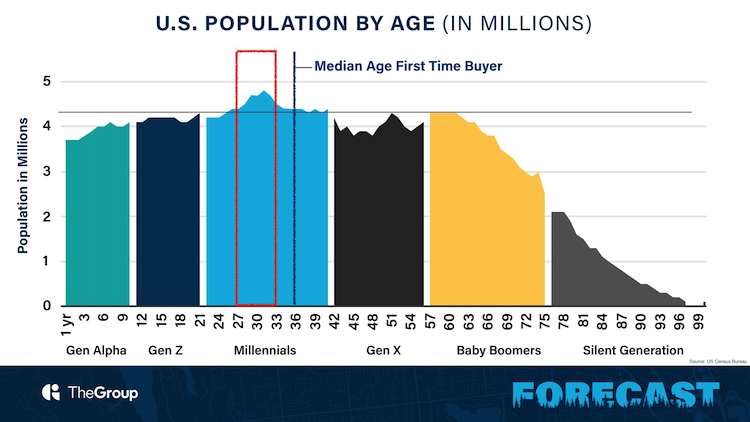

The millennial generation has been a topic in years past, and is once again at the forefront of our minds, as we ask ourselves, “Where is the demand for housing coming from?”

Millennials have experienced a double-whammy throughout the course of their young adulthood. This is a generation that was exiting college when the Great Recession hit, so they had a subdued timeline when it came to earning an income, alongside carrying the highest student debt on record for a generation. And they got hit once again with the increase of mortgage rates in 2022.

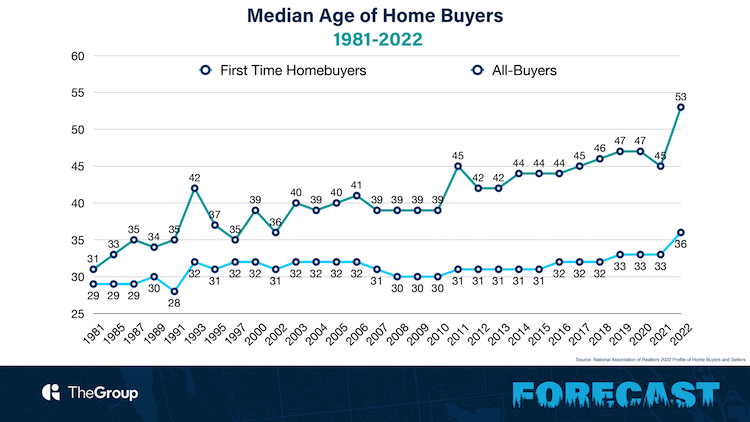

Wells examined the median age of home buyers going back to 1981, showing a sharp increase this last year. The median age of all home buyers jumped from 45 in 2021 to 53 in 2022, and for first-time home buyers from 33 to 36, which is the highest number on record. This was due to the increased housing prices, which those further along in their careers were more able to afford.

However, there is a massive amount of demand support from the millennial generation, as roughly 96% of millennials want to own a home, according to surveys. Not to mention, there is a massive population of millennials — roughly 20-25 million — who are just now coming of age to buy a home, providing major demand support in the coming years.

Strength in Employment

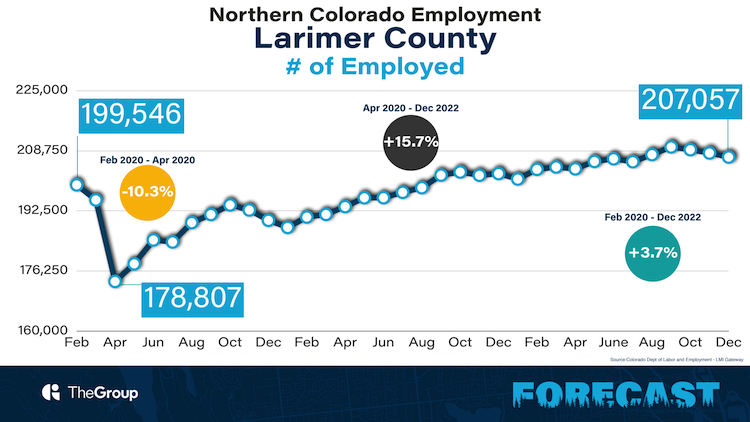

In our annual forecast, we’ve always said that employment is typically a 12-18 month leading indicator of what we can expect in the real estate market. This was certainly challenged during the pandemic, when we saw things we’ve never seen before when it came to the shutdown of the U.S. economy, and how that in turn affected employment.

Overall, employment has recovered to slightly above pre-pandemic levels. From February 2020 to December 2022, Larimer County has recovered 3.7%, Weld County is about the same, dipping -0.3%, and Boulder County went up 2.7%. As for the unemployment rate, the state as a whole went down, as well as Larimer and Boulder Counties, and Weld county stayed the same. Overall, the outlook is good as it stands for employment in these counties — and throughout Colorado.

The Boulder Benchmark

One of the tools we use to understand the local housing market is the Boulder Benchmark. This comparison examines three homes: one in Boulder, one in Greeley and one in Fort Collins. Carefully selected, each home was built by the same builder around the same time, has the same number of beds and baths with comparable square footage, and was sold in 2022.

This year, we looked at three homes built in the 1950s. Watch the Boulder Benchmark to see how they compared.

Development & Density

To wrap up our 2023 Forecast, representatives from three Northern Colorado communities participated in a panel to discuss key planning and development objectives for the year ahead. The panel included Scott Ballstadt, Director of Planning for Windsor, Bob Paulsen, Planning Manager for Loveland, and Don Taranto, Public Works Department Director for Timnath.

For all three communities, there were common themes. Across the board, we are seeing smaller lots, slightly smaller homes, more attached and multi-family housing, and an overall diversification of product. This means communities are being built with a variety of housing plans available, from condos and townhomes to detached single-family homes, all sharing amenities.

The panelists shared some exciting projects on the horizon, in both the residential and commercial sectors. These include a major mixed-use project with a Whole Foods in Loveland, RainDance and Future Legend Sports in Windsor, and Timnath Ranch and the Harmony Corridor in Timnath.

Final Advice

Wells closed the evening with some key pieces of advice for buyers, sellers and investors. For buyers, he encouraged them to stop trying to “time the market,” as that is essentially impossible to do. Instead, he said there are many great opportunities out there, both on the new construction and residential resale side. Don’t miss opportunities that might be happening within a short window!

For sellers, it’s important to be realistic and strategic with pricing. It is still a seller’s market, but you’re not in the driver’s seat like you were before. And for investors, Wells said rental rates are still promising but are seeing a downward trend; there’s still competition but don’t be so aggressive with pricing.

Watch the Forecast + See More Statistics

If you missed our Annual Real Estate Forecast, you can watch it here. Plus you can download the presentation slides and our 2022 Annual Report for more in-depth information and graphs.

Comments