On January 26, The Group broadcasted its Annual Real Estate Forecast virtually. Group President and CEO Brandon Wells recapped some of the overarching themes we saw in 2021 and forecasted our predictions for 2022, based on data from reliable sources in the industry and our own decades of experience.

Plus, we heard from Jason Peifer of Group Mortgage and Elizabeth Garner, State Demographer and Economist from the Colorado Department of Local Affairs.

As much as 2020 seemed to make the real estate world shake, rattle and roll, 2021 was nearly every bit as dynamic. In fact, 2021 was a record-breaking year for days on market, median sales price, and mortgage rates. Let’s take a closer look at some of the prominent trends that emerged and shaped the real estate market in Northern Colorado over the past calendar year.

A LOOK BACK AT 2021

Predictions vs. Reality

Over the years, our forecasts for home sales and average sales price have been between 95 and 99 percent accurate. This year, our prediction for residential transactions in 2021 was 93 percent accurate and our prediction for average sales price was 98.5 percent accurate — we’ll take it! We forecasted 12,226 sales and 13,148 sales actually occurred in 2021. We predicted $461,667 for our average sales price, which ended up being $454,706.

During the Annual Forecast, Wells detailed the number of home sales and average sales prices for cities in Northern Colorado, including Fort Collins, Loveland, Windsor/Severance, Greeley/Evans, Timnath, Wellington, Berthoud, Johnstown, Longmont, Boulder, and a combination of Ault, Eaton, Kersey, and La Salle. To see a statistical breakdown of each of these areas, check out the presentation slides from our Real Estate Forecast.

The “No Inventory” Myth

Inventory moved fast in 2021 — creating an extremely competitive market — and leaving standing inventory in short supply. Traditionally, a balanced housing market is characterized by six months of supply, meaning enough houses are available that it would take six months to sell them all, based on historical buying trends. Except for homes priced over $1 million, supply was at less than two months across the region.

Wells dispelled the “no inventory” myth, sharing that the United States as a whole saw 6.1 million homes sold this year, which is the highest number since 2006. And locally, Windsor, Loveland and Fort Collins all had an increase in the number of annual closed sales, proving that the inventory is there and we experienced an increased velocity in home sales.

“It’s not that there’s no inventory. It’s that there is no standing inventory,” Wells explained.

Water Wars

Water has, and will continue to be, a major issue for Northern Colorado as well as the state. As we have seen in the past two years, access to water – and the soaring cost – has impacted development for developers and for communities across Northern Colorado.

For example, Wellington raised water tap fees by $40,000 as the town did not have a viable water source to meet the needs of future development. In an effort to address the situation, Wellington’s fee increase was an easy way to curb demand while the town determines its approach for alternatives for supply.

Severance and the northern part of Timnath are also impacted by the availability of water. The North Weld Water District, a primary provider for both communities, faces the dual challenge of appropriation and supporting the infrastructure needed to deliver adequate water supply to developments. While North Weld analyzes its infrastructure and appropriations challenge, moratoriums have been placed on the issuance of new water taps and permits. The timeline of removing these moratoriums is still in question as we start the year.

Dynamic Development

The homebuying rush that started in 2020 hit full speed in 2021. With buyers competing for resale properties and bidding up prices all along the Front Range, more people looked to new construction as a solution.

But homebuilders confronted challenges of their own. Knots in the supply chain put builders in a bind. As lumber prices soared, some builders were forced to squeeze their margins on projects that were already under contract. And for new contracts, it was difficult to accurately price the project for their customers. Eventually, returning to customers to adjust contracts became an uncomfortable condition of doing business.

In addition to fluctuating costs, there was the lack of access to basic housing materials (i.e., doorknobs, kitchen fixtures, etc.). Consequently, some builders simply had to stop taking on new contracts until prices became more predictable or supplies became more reliable.

Last year brought another wrinkle to the new construction conundrum: a lack of building-ready lots. In response to buyer demand, some builders burned through their available lots in 2020 or early 2021 and were suddenly scrambling for land for future homes.

“The home building puzzle has never been more complex,” Wells said.

The Great Resignation

Employment is always part of the foundation of any local real estate market. We usually point to job and wage growth today as an indicator of housing demand (going up or down) 12-18 months into the future.

But the employment story took on a different dimension in 2021 with the emergence of “The Great Resignation” – the wave of Americans leaving their jobs to find better pay or better lifestyles elsewhere. In fact, in November 2021 alone, a record of more than 4.5 million people voluntarily left their jobs. With rising inflation, employers are under increasing pressure to respond to the changing expectations of their workers (more on that later!).

Despite the impacts of the Great Resignation, employment in Northern Colorado has bounced back significantly from the employment drop that occurred at the start of the pandemic. In Larimer County, employment went down 13.7% as a result of the pandemic, and is now up 11.1% since that drop. In Weld County, employment went down 12.8%, and is now up 10.4%. And in Boulder County, employment went down 10.4%, and is now up 10.3%. All in all, job recovery looks promising for Northern Colorado.

More Interest in Rates

Jason Peifer of Group Mortgage took us through the details of another historic year for mortgage interest rates.

Rates started out historically low in January (an average of 2.67 percent on 30-year fixed loans), and took turns rising and falling throughout the year, largely due to the economic twists and turns of the pandemic.

Rates nosed up in the spring, reaching a 3.18 percent as of April 1, then made their way back down through summer, dipping to 2.77 percent by early August. Since then, as inflationary pressures became more obvious, and the Federal Reserve became less accommodating, the rates have gradually increased – reaching 3.45 percent as of January 13.

Population Growth

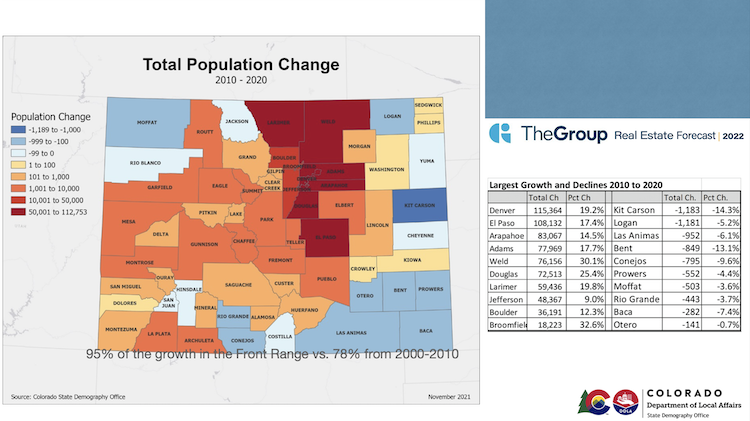

For this year’s forecast event, we welcomed State Demographer and Economist Elizabeth Garner, who shared fascinating data about the state’s population growth and demographics, and how it impacted the real estate market here in Northern Colorado.

Some key takeaways and themes from Garner’s presentation include:

-

In both the U.S. and Colorado, the population is growing at a slowing rate, as births are down and deaths are up

-

Both migration and mobility are slowing

-

It is harder to attract and retain the best and brightest

-

Labor is tight and competitive in the U.S.

-

NoCo is experiencing concentrated growth

-

Colorado as a state is aging, which impacts everything, including the labor force, housing and public finance

-

The largest share of future growth is the 65+ age group

-

Colorado is experiencing an increase in racial and ethnic diversity, especially in the younger population

LOOKING FORWARD TO 2022

Our Predictions for 2022

2022 will be another banner year for Northern Colorado residential real estate. However, the dynamics of a rising interest rate environment may raise some questions about the potential growth opportunity of the housing market. The overall homeownership equity growth since the Great Recession will continue to fuel movement. While Northern Colorado will continue to see new construction growth, the limitations imposed by lack of skilled labor, as well as supply chain issues for materials, and the overall cost of both will drive prices higher in 2022. The impacts of events like the Marshall Fire have added additional variables that certainly will further reduce the availability of resources (labor and materials) making it more difficult to match the demand and interest of prospective buyers fighting to get into or move around in this market.

For 2022, we predict there will be 13,500 home sales in Northern Colorado, up from the 13,148 we saw in 2021. And for median home price, we predict it will be $550,000 for Fort Collins and $480,000 for Loveland in 2022. To see the predicted average home price for all cities throughout Northern Colorado, check out the presentation slides from our Real Estate Forecast.

Employment

As a result of the Great Resignation, employers — both locally and nationally — appear to be facing three options: They can 1) increase pay to retain employees and help them keep up with the cost of living, 2) use technology to make their businesses more efficient, or 3) take advantage of the potential for remote workers who can provide services while living in lower-cost communities.

The cost associated with housing continues to be a primary driver of higher wages on top of inflationary pressures. And 2022 will also see impacts in rental rates, as many owners were anxious about raising rents due to eviction moratoriums. Those inflationary pressures and high demand will see heavier increases in rental rates this coming year.

What’s it all mean for real estate? These tough decisions by employers today will become evident in the housing market 12-18 months from now. Stay tuned.

Interest Rates

If the Fed follows through on its intent to curb inflation – tightening monetary policy and increasing interest rates – mortgage rates are bound to keep rising. Still, it’s important to keep perspective. Even if rates move higher, they are very low from a historical perspective, and Fed actions over the last few years show they will be vigilant to maintain a stable housing market.

Population Growth

State Demographer Elizabeth Garner also shared the forecast related to the state’s population and migration in the coming years. She predicted that:

-

Births will continue to slow and deaths will continue to increase (as the population is growing older)

-

Migration will return to 2019 pre-pandemic levels

-

We will continue to see migration from states like California, New York, Texas and Illinois

-

We will see “part-time” residents and people moving to more rural areas in the state, as remote work continues

-

Colorado will bounce back after the pandemic

Watch the Forecast + See More Statistics

If you missed our Annual Real Estate Forecast, you can watch it here. Plus you can download the presentation slides and our 2021 Annual Report for more in-depth information and graphs.

Comments