Average housing prices in the Fort Collins/Loveland and Greeley markets are experiencing their greatest increases in over a decade, a trend that could bring fresh opportunities to homeowners. In its 2013 year-end report, the Federal Housing Finance Authority (FHFA) ranked both Northern Colorado cities among the top 25 percent of metropolitan markets for price appreciation. FHFA tracks nearly 300 metropolitan areas across the United States using a repeat-sale index.

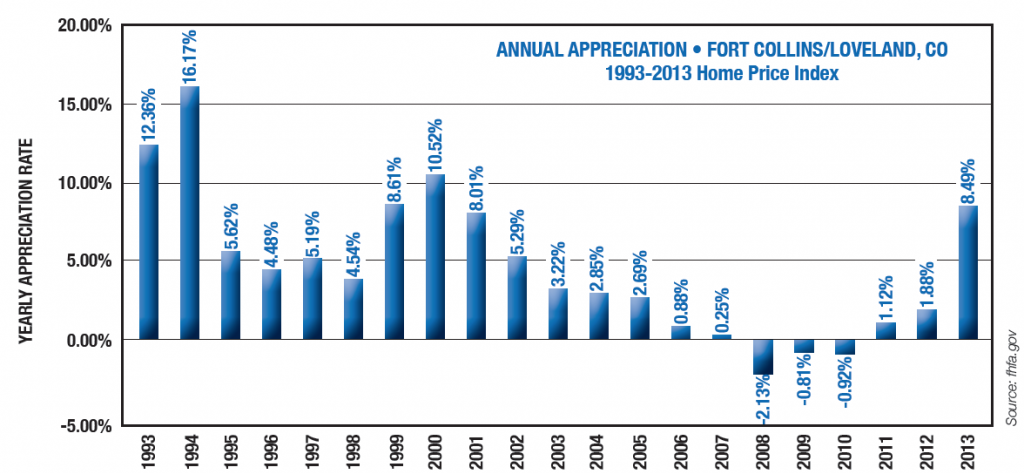

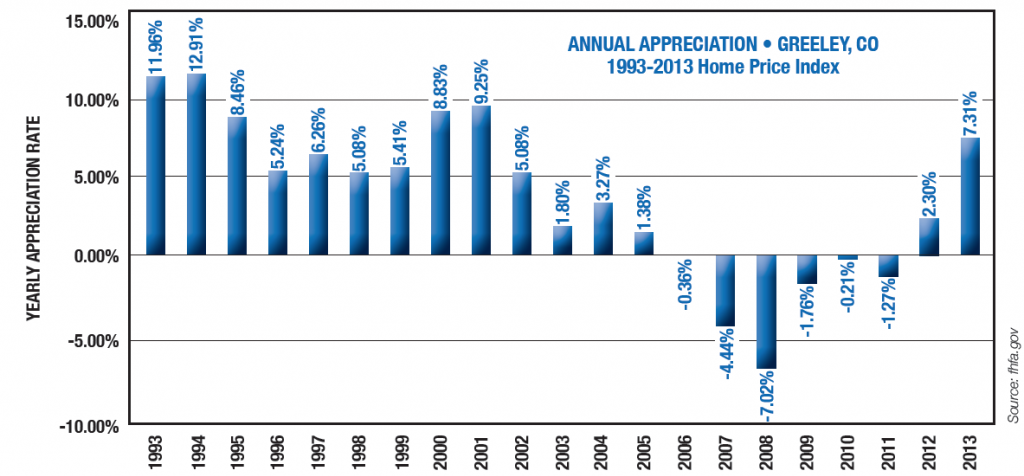

The following charts show a 20-year history of the Fort Collins/Loveland and Greeley markets:

The Fort Collins/Loveland market increased 8.49% in 2013, the largest increase since 2000. The Greeley market increased 7.31% in 2013, the largest increase since 2001.

WHAT THIS MEANS FOR SELLERS

Because Northern Colorado’s dramatic price increases in 2013 follow several years of flat price appreciation, homeowners may not realize the value of their home today. Increased demand and low inventory in most price ranges has created an ideal time to list a home for sale. A detailed market analysis performed by a local expert can be a useful tool to get started.

WHAT THIS MEANS FOR BUYERS

Given the population growth and job growth in our region, demand is expected to remain high for the next several years. Prices should continue on their current trajectory. The good news for buyers is that increased prices will cause more homeowners to put their home on the market, yet time is not on the side of buyers. Because most experts expect interest rates to rise by 1%, the greatest risk for a potential buyer today is to wait. A 1% increase in interest rate translates to a 10%

reduction in buying power.

Comments